As climate change accelerates, governments are exploring different strategies to limit greenhouse gas (GHG) emissions. Among the most widely used tools is cap and trade a policy that blends environmental regulation with market dynamics to incentivize emission reductions. Though not without controversy, cap and trade has been adopted across dozens of countries and regions with varying levels of success.

Cap and Trade: A Quick Overview

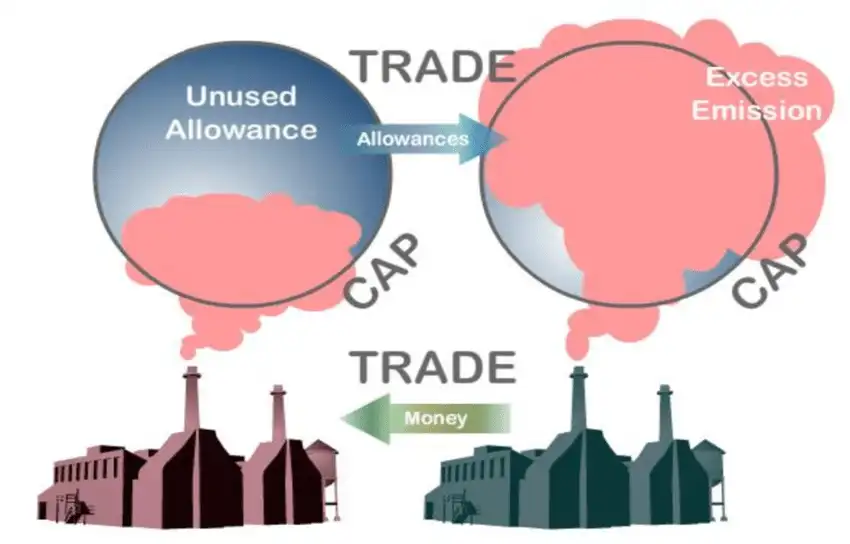

Cap and trade is a market-based approach to controlling pollution. Authorities set a limit or cap on total emissions for participating entities. Companies receive or purchase allowances, each representing the right to emit a specific amount of GHG. If a firm emits less than its allowance, it can sell its surplus; if it exceeds the limit, it must buy extra credits or face penalties. The goal is to drive emissions down over time by gradually lowering the overall cap.

Alternate Names for the System

This approach is also referred to as:

- Emissions trading

- Emissions Trading Scheme (ETS)

- Cap and invest (as seen in Oregon)

Policy Origins and Background

Cap and trade traces its conceptual roots to economist Thomas Crocker in the 1960s. However, the first large-scale implementation didn’t occur until 2005, when the European Union launched its ETS, still the world’s largest emissions trading program. Ironically, Crocker later said he preferred a carbon tax over his original idea, citing doubts about cap and trade’s efficiency in managing carbon emissions.

Today, more than 80 global jurisdictions including 47 countries and 36 sub-national regions have adopted some form of carbon pricing, either through cap and trade or a carbon tax.

How Cap and Trade Works in Practice

The EU Model

Within the EU’s ETS, companies are assigned emissions allowances each equal to one metric ton of CO2 or its equivalent. These are distributed via auction or free allocation and tracked through a Union Registry account. Firms can trade allowances with each other, creating a functioning market. Any company that exceeds its cap without sufficient allowances faces fines.

The value of emissions has grown significantly. In 2022, prices for one EUA (EU Allowance) ranged from €58 to €100 per ton, pushing firms to curb emissions for cost savings.

Key Features

- Caps tighten annually to push reductions

- Firms can buy or sell allowances

- Revenue from auctions funds climate initiatives

- Trading is conducted via official registries

Global Examples of Cap and Trade in Action

European Union

Since its launch, the EU’s ETS has cut emissions from participating sectors by about 43%. The program currently spans all 27 EU member states plus Norway, Iceland, and Liechtenstein.

China

Launched in 2021, China’s ETS is now the world’s largest national carbon market. Though still in early development, the system already shows promise regional pilot programs reduced emissions intensity by nearly 10%. However, early issues, including falsified emissions data, highlight the importance of transparency and regulation enforcement.

United States

While the U.S. has no federal cap-and-trade policy, several regional initiatives are thriving:

- RGGI (Regional Greenhouse Gas Initiative) covers fossil-fuel power plants in the Northeast and Mid-Atlantic. Since its inception, RGGI states have reduced carbon emissions by 47% while growing GDPs and lowering electricity costs.

- California’s Cap-and-Trade Program began full implementation in 2012. It helped the state meet its 2020 emissions targets years early and now forms part of a plan to achieve carbon neutrality by 2045.

- Oregon and Washington are developing similar systems with strong environmental goals.

Pros and Cons of Cap and Trade

Advantages

- Creates a market-based incentive to reduce emissions

- Generates government revenue through allowance auctions

- Flexibility in how businesses meet emissions targets

- Can be applied to multiple GHGs, not just CO2

- Cap can be tightened over time to further reduce emissions

Disadvantages

- Firms can buy their way out of emissions cuts

- Caps may be set too high, reducing program effectiveness

- Risk of fraud in self-reported emissions data

- May lead to increased energy costs for consumers

- Not as straightforward or transparent as a carbon tax

Cap-and-Trade Outlook: What Lies Ahead?

Many regions are now considering hybrid models that combine cap and trade with carbon taxes. This dual approach aims to balance market incentives with clear, consistent pricing for emissions. Countries like Canada, New Zealand, and Mexico are leading in this space, while the U.S. continues to debate national policy options.

Notably, while California’s program has seen success, it faces criticism for not doing enough to meet 2030 goals. Legislators are considering adjustments potentially moving toward a hybrid system to accelerate progress.

Frequently Asked Questions

What does “cap and trade” mean?

Cap and trade refers to a policy where governments limit total emissions and let companies trade allowances. Firms emitting less than their limit can sell the excess; those exceeding must buy more.

What is the purpose of cap and trade?

The goal is to reduce overall emissions efficiently and cost-effectively while encouraging innovation and investment in cleaner technologies.

Does cap and trade help the environment?

Yes, when implemented effectively, it lowers emissions and provides funding for green initiatives. However, its success depends on strict enforcement and appropriately set caps.

How widely is cap and trade used?

Cap and trade is in use in over 80 national and sub-national jurisdictions, covering 23% of global GHG emissions.

Cap and trade isn’t a silver bullet but it’s a powerful tool in the fight against climate change. When carefully structured and transparently managed, it can drive meaningful emissions reductions while spurring innovation and economic growth. As climate pressures mount, expect to see cap-and-trade systems evolve possibly merging with carbon taxes as governments seek more effective, equitable solutions to decarbonize our planet.